Helix Energy Solutions: Buy Ahead Of Major Earnings Improvement (NYSE:HLX)

Sergei Dubrovskii

Houston-primarily based Helix Power Solutions Team, Inc. (NYSE:HLX), or “Helix,” is one particular of the world’s top offshore vitality specialty solutions providers.

The enterprise operates as a result of three segments: Well Intervention, Robotics, and Manufacturing Services, with the nicely intervention enterprise presently contributing close to two thirds of revenues.

Helix not long ago acquired the Alliance team of firms (“Alliance”) for $120 million in dollars, a Louisiana-based mostly supplier of expert services in guidance of the upstream and midstream industries in the Gulf of Mexico shelf, such as offshore oil discipline decommissioning and reclamation, project management, engineered options, intervention, maintenance, maintenance, large elevate and business diving solutions.

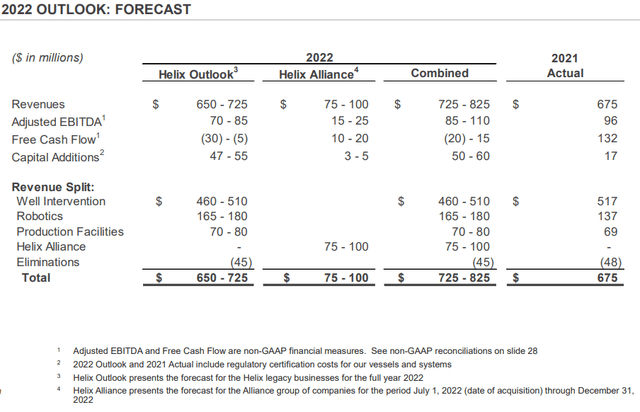

The acquisition will add Adjusted EBITDA of up to $25 million and maximize consolidated revenue by somewhere around 15% this yr.

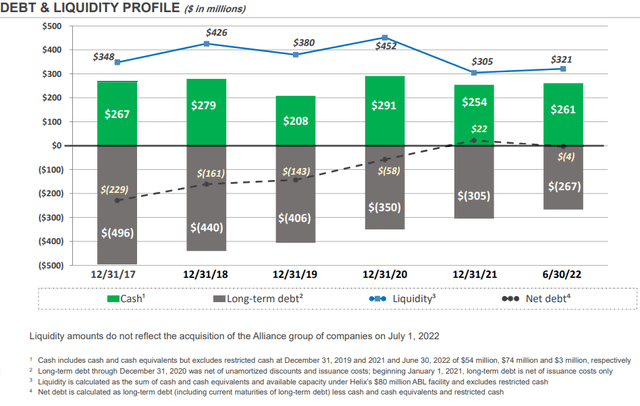

Helix has carried out quite very well for most of the industry downturn as economical final results had been boosted by a selection of substantial-margin legacy contracts. As a result, the organization has not only managed to remain afloat but also decreased financial debt substantially in current several years:

Business Presentation

Make sure you notice that the recently accomplished Alliance acquisition will minimize hard cash on hand by $120 million future quarter.

That claimed, management expects 2022 to be a changeover calendar year with numerous vessels going through regulatory inspections, a slow return for the North Sea current market and a amount of units doing quick-time period do the job at lessened fees with the firm’s two contemporary effectively intervention vessels in Brazil producing an approximated $35 million EBITDA strike by itself.

As a result, the blended company’s free money stream will only be around split-even stages, down from $132 million recorded previous yr:

Enterprise Presentation

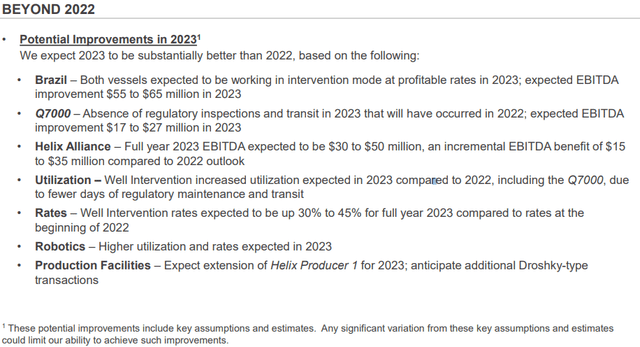

But issues are envisioned to improve for the greater going into the second half and subsequent yr as small business problems are strengthening throughout all segments as stated by management on the Q2 conference phone:

Much better utilization, increasing premiums and in certain locations of the company, costs are strengthening much better and more rapidly than we predicted together with far better terms and ailments. We are securing for a longer time term contracts and searching to see more get the job done with some of the Very well Intervention assets into 2025.

(…)

Not only have the uncertainties of 2022 getting obvious, we also have probably the finest visibility in the latest decades at this place for what may well occur next 12 months in 2023.

(…)

We’ve termed 2022 a transition yr for Helix. We totally intend to transition from a weak marketplace in ’22 to a high demand from customers industry in ’23 and outside of.

In the Q2 presentation, Helix projected up to $127 million in EBITDA enhancements in 2023 centered on anticipations for perfectly intervention costs remaining up among 30% and 45% for the whole yr when compared to premiums at the starting of 2022.

The company also forecasted larger utilization and rates for the Robotics phase future yr.

Business Presentation

Personally, I am expecting Adjusted EBITDA of at the very least $225 million in 2023, a lot more than double the significant conclusion of the firm’s projection for this calendar year.

At this degree, Helix need to return to sizeable absolutely free funds flow generation upcoming calendar year.

With the company trading at just 2.7x EV / Altered 2023 EBITDA in spite of current expectations for a multi-year recovery in the offshore oil and fuel markets, Helix seems to be remarkably low cost.

Base Line

When 2022 will be practically nothing to produce residence about for Helix Energy Alternatives, the firm jobs significant improvement going into upcoming year with the prospective to at the very least double Adjusted EBITDA from expected 2022 ranges.

Even after the modern acquisition of Alliance, Helix proceeds to have a strong stability sheet with very low web credit card debt levels and respectable liquidity which need to increase considerably more than the next few of quarters.

With the company investing at just 2.7x projected EV / Adjusted 2023 EBITDA, Helix appears to be very low cost.

That reported, with shares up by practically 40% from recent lows, investors should really look at waiting around for a setback rig

ht before opening a position.

Get very long Helix Strength Options to attain publicity to the expected multi-year recovery in offshore oil and gasoline products and services. Assuming no key offer-off in oil costs, I would anticipate shares to double from present levels going into upcoming year.